Become a member for special access to membersonly videos, live streams, live chats, behind the scenes, and MORE! Both Client and Independent Contractor represent and warrant that each Party has full power, authority and right to execute and deliver this Agreement, has full power and authority to perform its obligations under this Agreement, and has taken all necessary action to authorize the execution and delivery of this Agreement1099 subcontractor agreement form Benefit from a electronic solution to develop, edit and sign documents in PDF or Word format on the web Transform them into templates for multiple use, add fillable fields to gather recipients?

Free Independent Contractor Agreement Template Download Wise

1099 contract agreement template

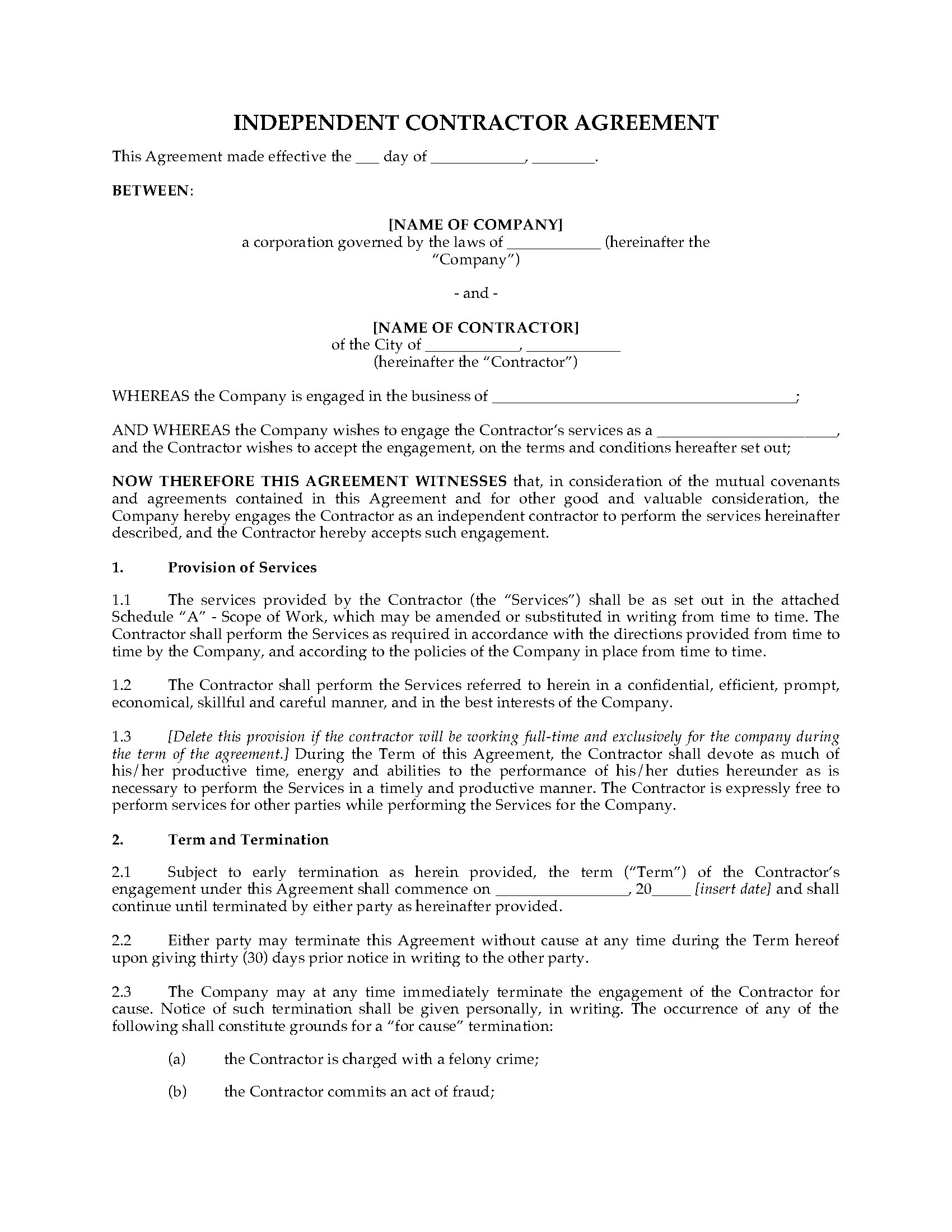

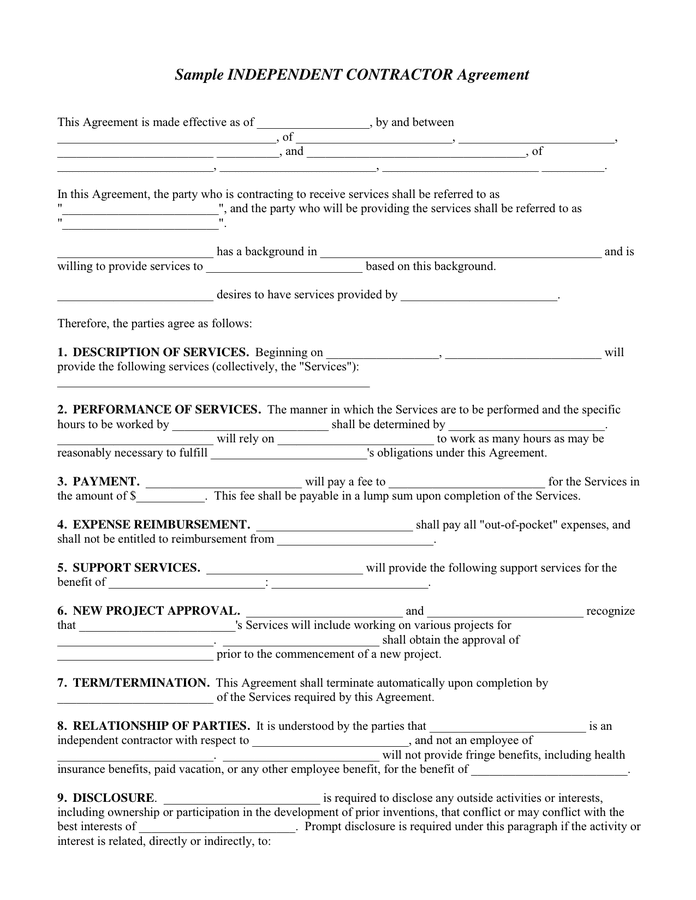

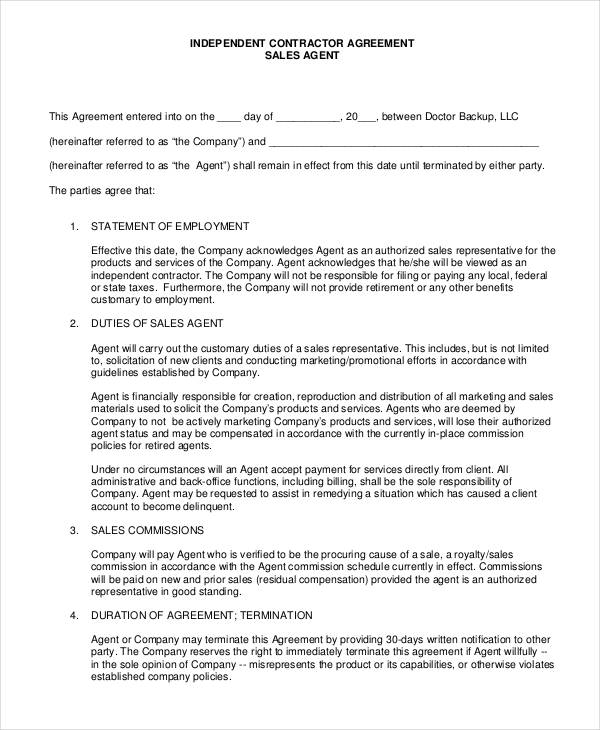

1099 contract agreement template-1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and _____("Contractor"), Federal Identification (or Social Security) _____INDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either party

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

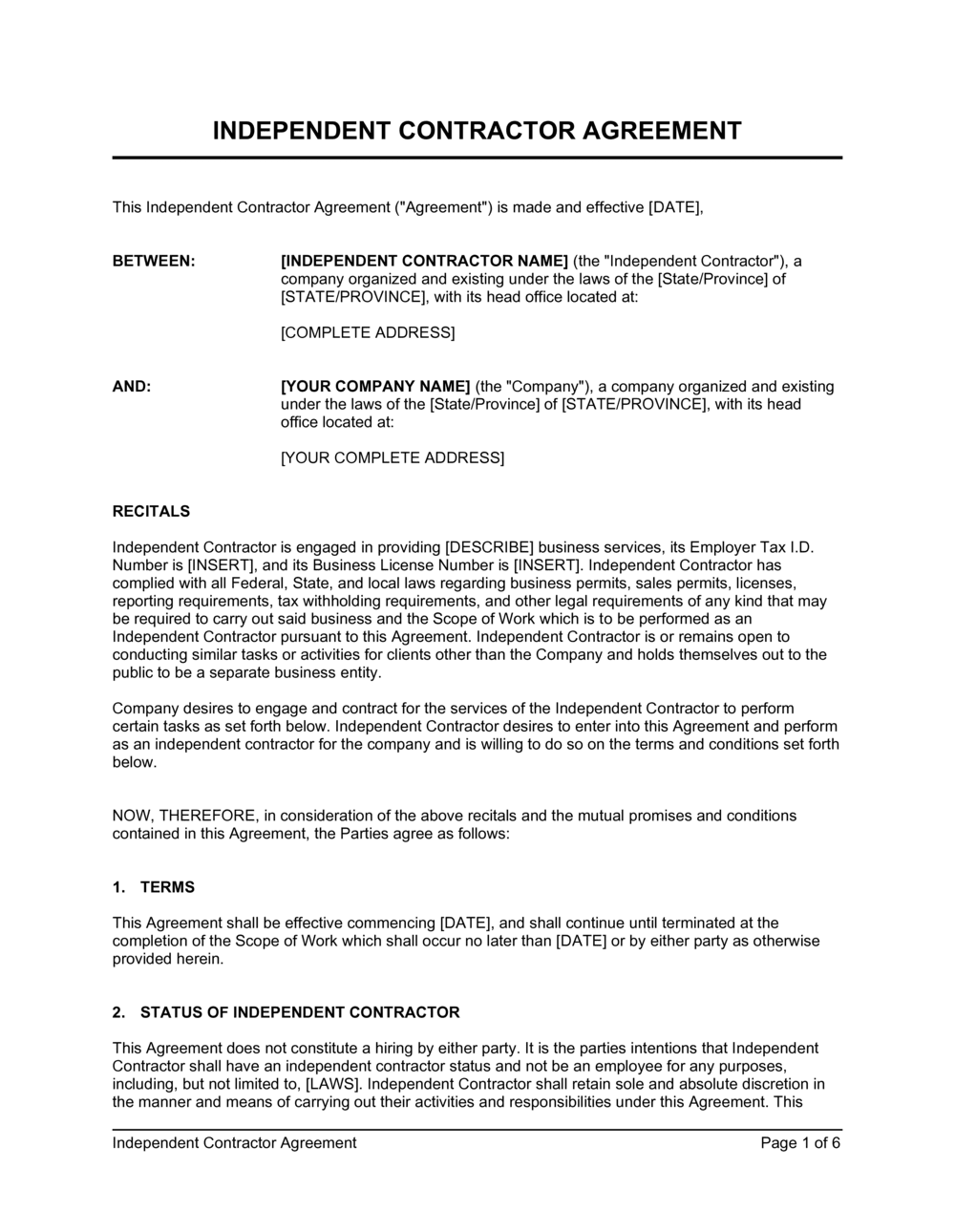

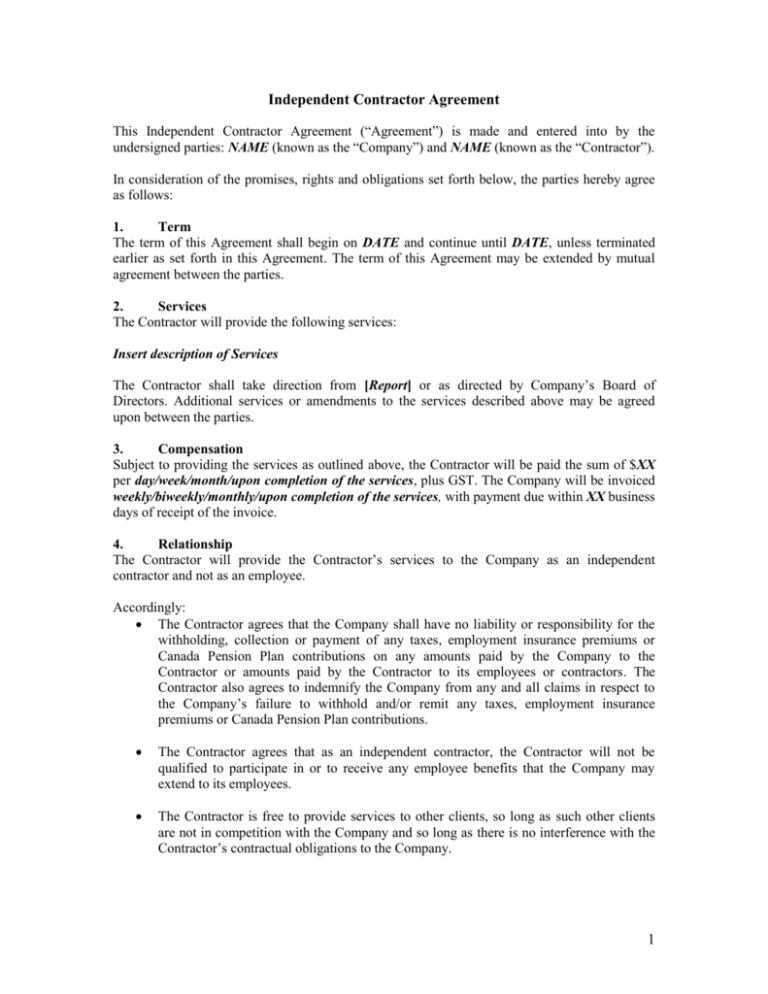

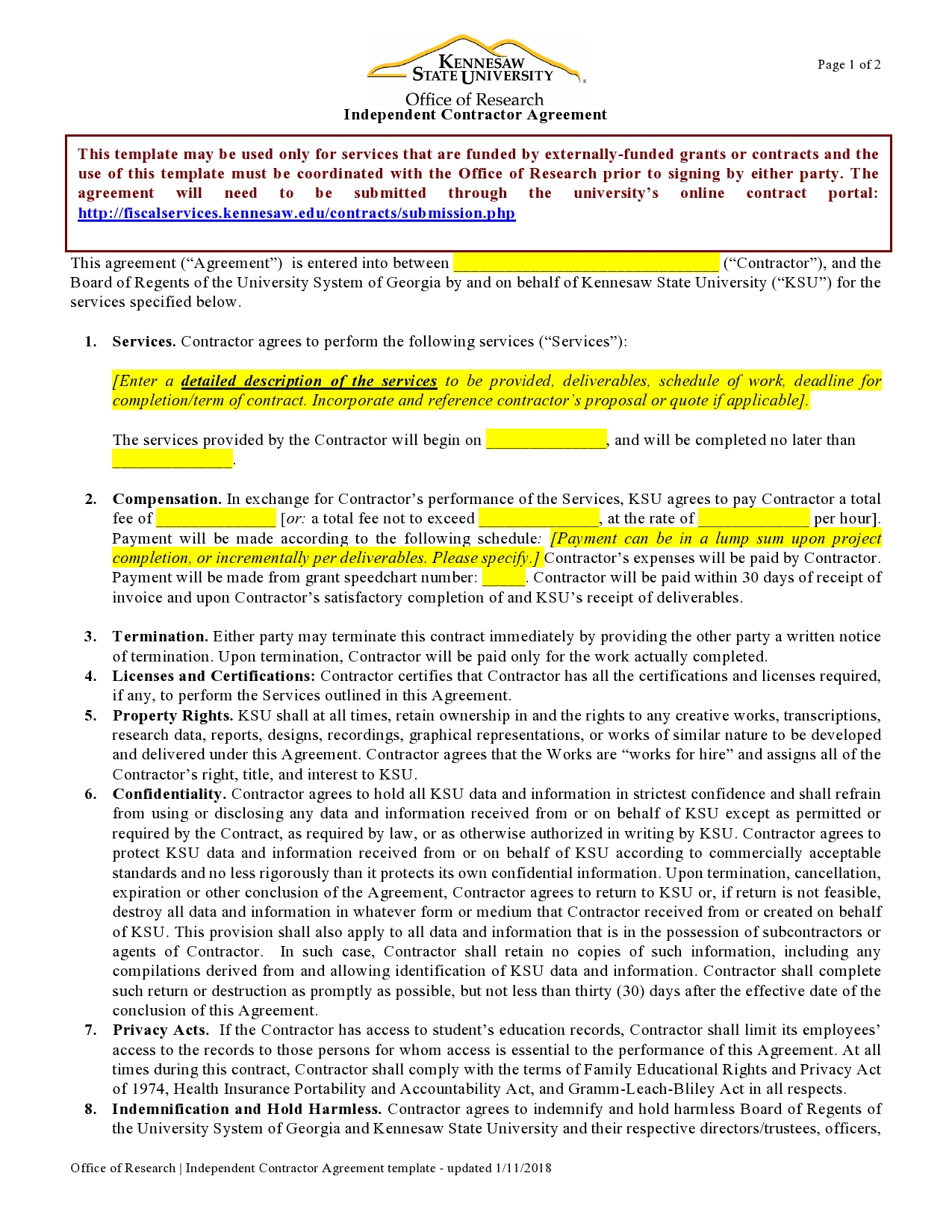

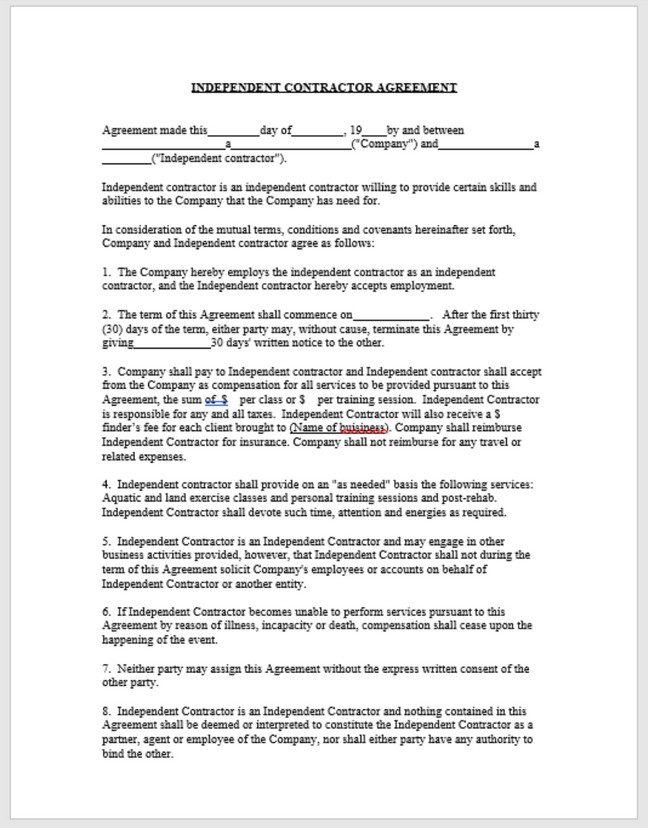

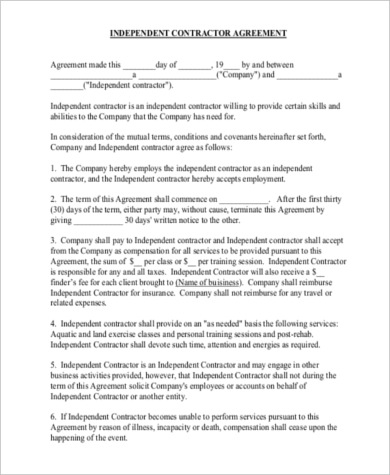

The Contractor acknowledges and agrees that the Contractor is an independent contractor and not an agent or employee of the Company The Contractor warrants that it will perform the services set forth in this Agreement consistent with the Company's Policy for Independent ContractorsAnd withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by Company to Contractor under this Agreement Contractor and Company further agree that 1 Contractor has the right to perform services for others during the term of this AgreementUse a independent contractor agreement template when working as an independent contractor for another business Set and clarify the terms of the job, and get paid into our smart new multicurrency business account A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach

Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and _____, having an address ofExamples One year with every 6 month renewal One year with automatic renewals Between CRNA and CRNA Contractor Termlength of contract Noncompete clause Independent contractor status Independent Contractor 1099 Control is the key Compensation Is there a minimum?That in performing under the Agreement;

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its Agreement Independent Contractor shall not disclose or use trade secret informationAgreement for Independent (IRS Form 1099) Contracting Services _____________________, referred to as CONTRACTING PARTY, and ___________________, referred to as INDEPENDENT CONTRACTOR, agree INDEPENDENT CONTRACTOR shall perform the following services for CONTRACTINGContractor acknowledges that it will be necessary for Client to disclose certain confidential and proprietary information to Contractor in order for Contractor to perform duties under this Agreement Contractor acknowledges that disclosure to a third party or misuse of this proprietary or confidential information would irreparably harm Client

Independent Contractor Agreement Full Time

Independent Contractor Agreements Free Printable Legal Forms

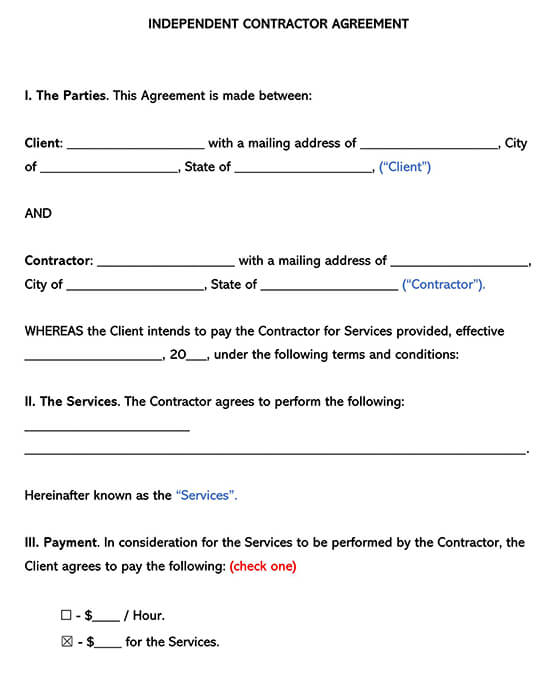

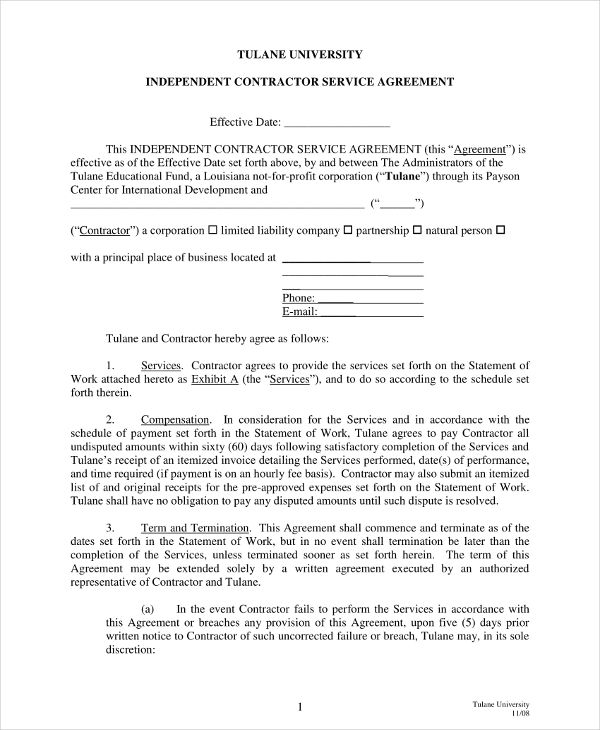

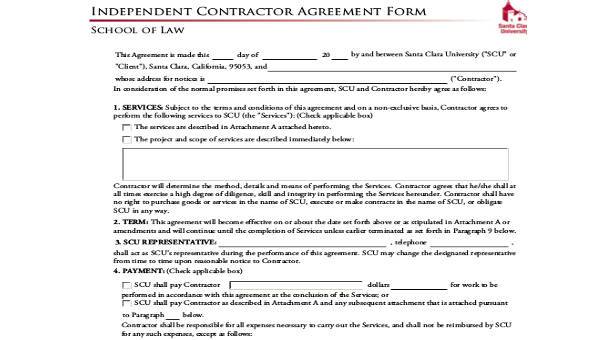

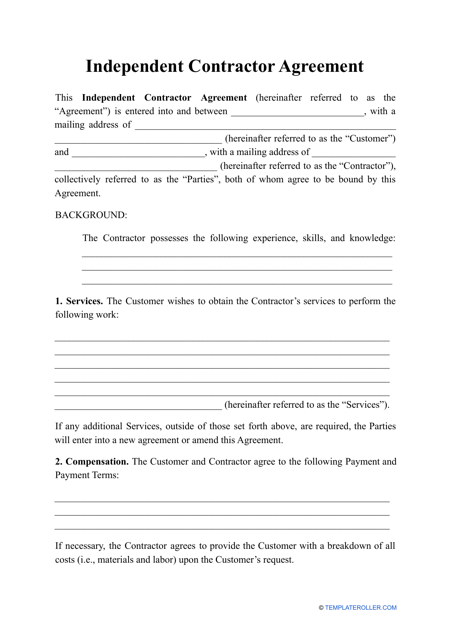

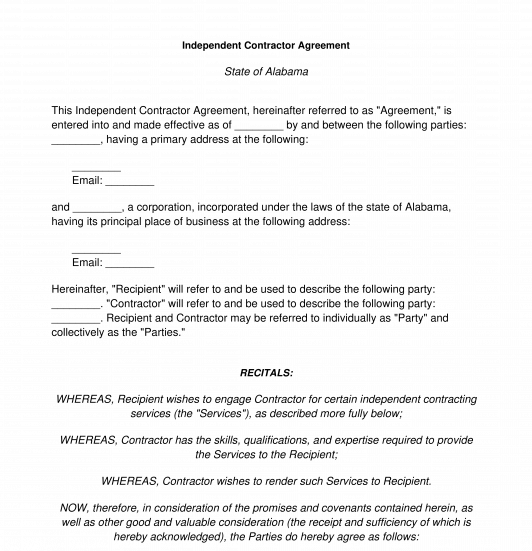

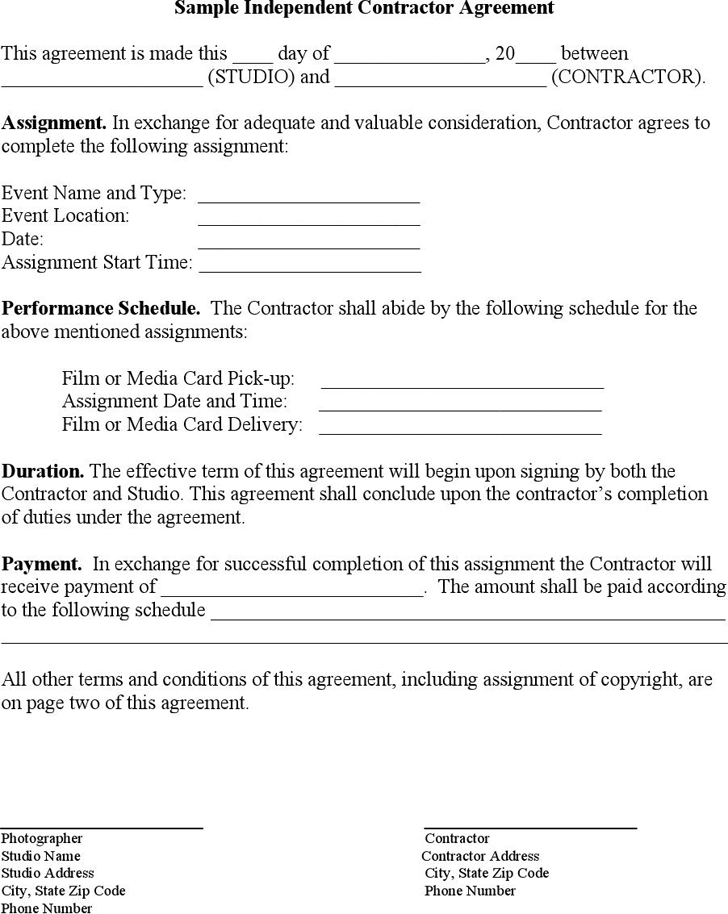

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details)Independent contractor agreement Download free template & sample Free doc (Word) and pdf independent contractor agreement template suitable for any industry and essential when hiring new employees for your business Independent Contractor Agreement is a written contract that outline the terms of the working arrangement between a contractor and client, including aAs well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTOR

Http Www Atri Org Articles Independent contractor agreement Pdf

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Want more All Up In Yo' Business? 1099 Contractor Agreement Template russellreichert Templates No Comments 21 posts related to 1099 Contractor Agreement Template 1099 Form Independent Contractor Agreement General Contractor Contract Template Inspirational Free Contractor Agreement TemplateOrder and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Free Independent Contractor Agreement Template What To Avoid

Free Texas Independent Contractor Agreement Pdf Word

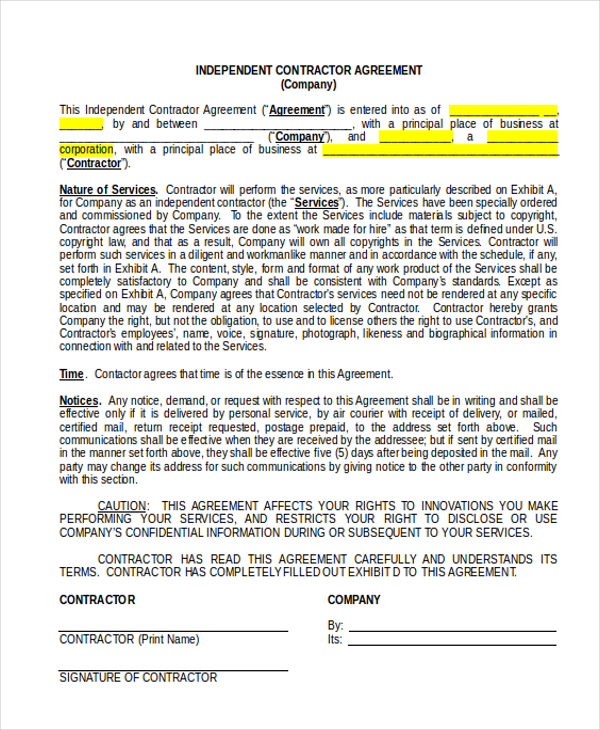

It may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the soleFree Elegant Form Independent Contractor Agreement New Simple Template simple from 1099 template example with resolution 638 x 903 pixel Sample 1099 Misc Filled Out Beautiful 1099 Misc form Template New 19 1099 excel template – friendscenterfo Make preparations for 13 Form 1099 filing Dye Whit b Tax and Contractor Invoice Templates Free Results Found Example 1099 , 15 form 1099Professional Services Agreement For 1099 Representative Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter

Independent Contractor Agreement Form Free Download

50 Free Independent Contractor Agreement Forms Templates

free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement template pdf an independent contractor agreement also known as a '1099 agreement' Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to(b) Contractor will not violate the terms of any agreement with any third party;

1

Free Independent Contractor Agreement Template Download Wise

Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because itsAgreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;CONTRACTOR will never solicit (while this Independent Contractor Agreement is and accounts receivable, and provide CONTRACTOR with 1099 tax forms c) Dispatching The COMPANY will maintain a telephone answering and appointment setting service for the INDEPENDENT CONTRACTOR

50 Free Independent Contractor Agreement Forms Templates

In Nau Edu Wp Content Uploads Sites 2 18 06 Independent Contractor Agreement Ek Pdf

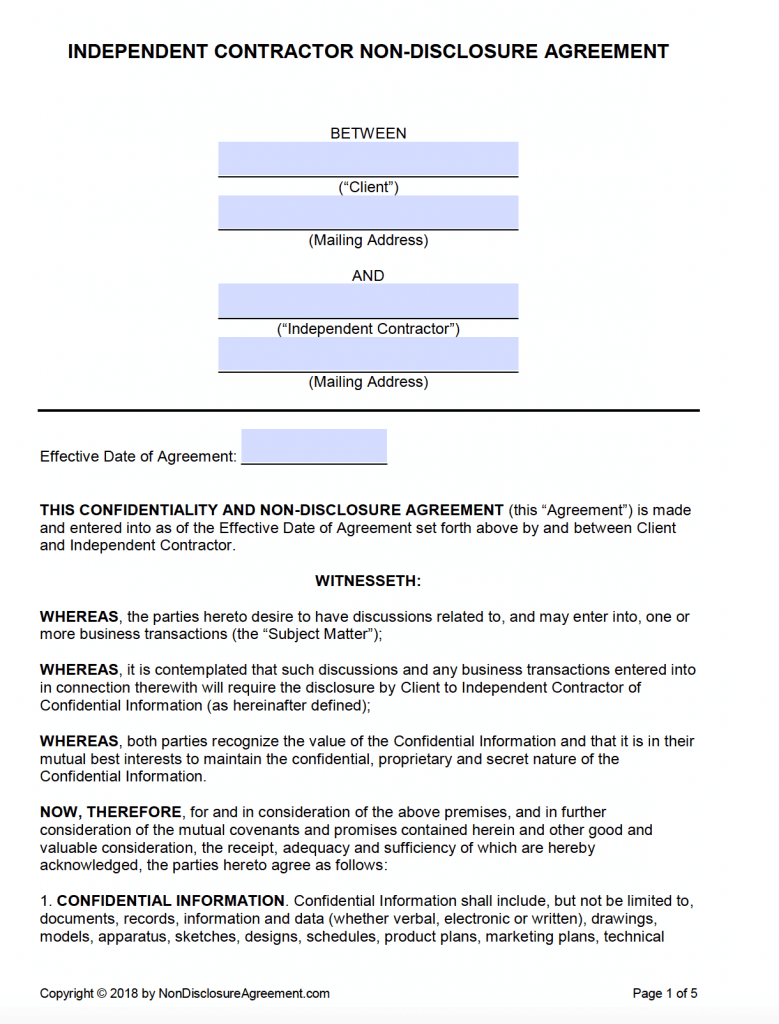

Email Word (2695 KB) The independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws3 Internet, Cell Phone Bill, Laptops & Gadgets Even if you don't take the home office deduction, you can deduct the cost of a phone you use for work, fax, and internet expenses But you want to make sure you are only claiming expenses directly related to your 1099 contracting work Updated A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year

Independent Contractor Agreement Printable Pdf Download

Agreement Between Chiropractic Physician As Self Chiropractic Independent Contractor Agreement Us Legal Forms

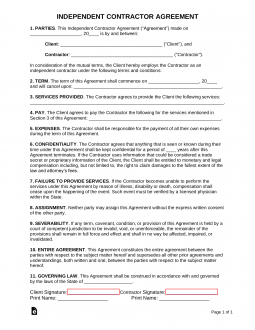

free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement template pdf an independent contractor agreement also known as a '1099 agreementContractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood that the Representative is solely responsible for the payment of all taxes on commissions paid by the Company under this AgreementINDEPENDENT CONTRACTOR AGREEMENT This Independent Contractor Agreement ("Agreement") made _____, ____ by and between _____ ("Employer") and _____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities

Usa Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

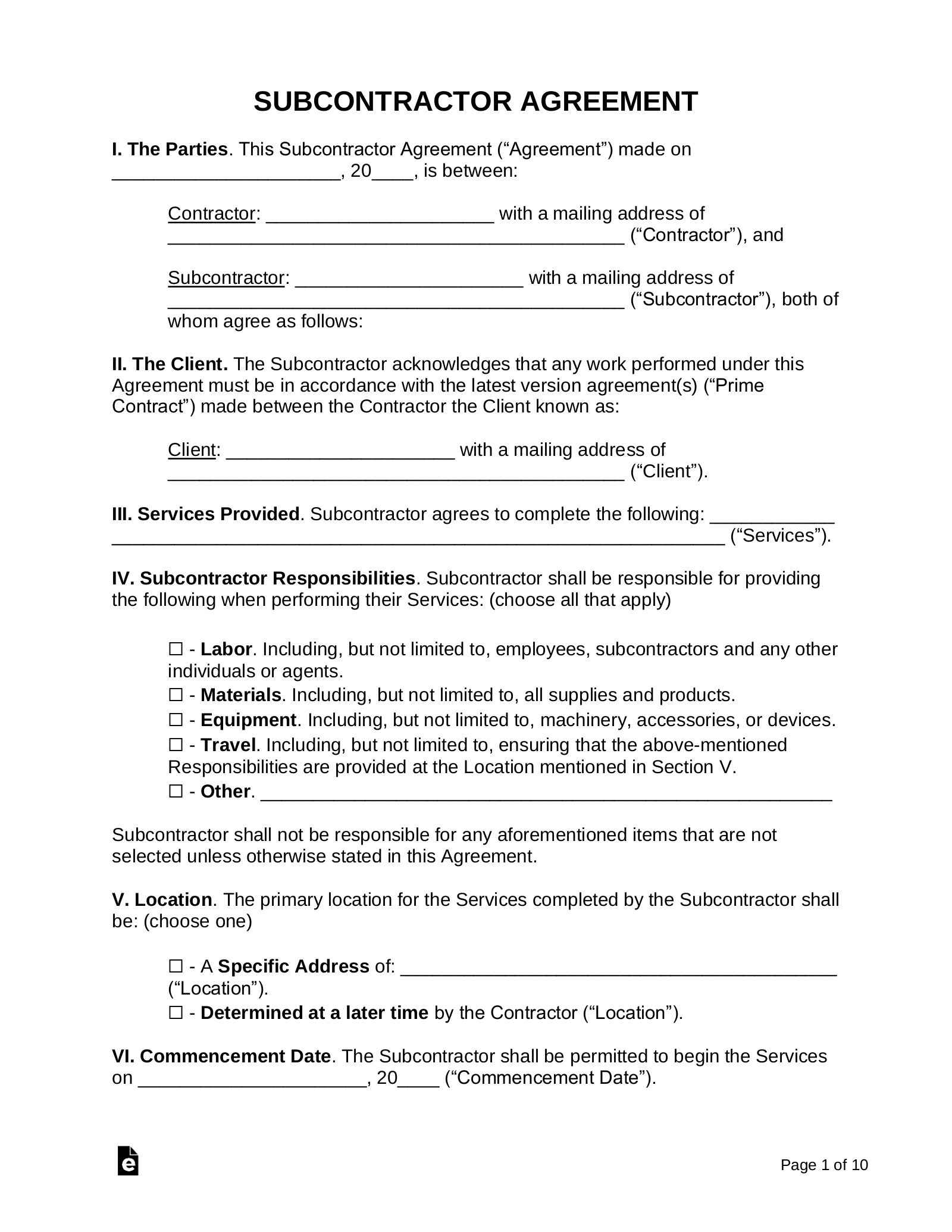

Independent Subcontractor Agreement Template 11 Subcontractor Agreement Template For Successful Contractor Company A Subcontract Agreement Template Is An A

These include a government subcontractor agreement template, a marketing subcontractor agreement, and a 1099 subcontractor form Independent Contractor Agreement An independent contractor is an individual or entity contracted to undertake work for – or provide services to – another entity as a nonemployee Society of Human Resource Management (aka SHRM) provides a barebones contractor agreement AIGA provides an excellent workbook and toolkit to create contracts and agreements for designers The Printing Industries of America has an easytoread template for subcontractor agreements This one clearly covers the issue of noncompete clausesLouisiana Subcontractor Agreement Template Loading The Louisiana subcontractor agreement is a contractual obligation between both contractor and subcontractor Recognized as a 1099employee, the document details the kind of service or product the subcontractor will provide

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

Free Independent Contractor Agreement Templates Word Pdf

Time Commitment Right to set your own compensationThis sample agreement template is signed between a sample contractor and a company, hence it should also include some provisions to cover any local law if applicable Both parties are governed with all terms and conditions such as term and termination of services, contractor services, Ownership and Liability, Confidential Information and other Miscellaneous ProvisionsIndependent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf of

Free Subcontractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Template By Business In A Box

Data, put and request legallybinding digital signatures Get the job done from any device and share docs by email or faxAnd (c) the Services andA business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and how

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

Independent Contractor Agreement Template Easy Legal Templates

Start your own Contractor Agreement here on LawDistrict now and follow our simple stepbystep instructions to set up a personalized final document Sign the agreement In the last step of this process the completed Independent Contractor Agreement needs to be signed by both parties to make it legally binding It's not a legal obligation to have the document signing witnessed,Contractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;

Independent Contractor Agreement Fetch Pet Care

Car Salesman Agreement Self Car Independent Contractor Agreement Us Legal Forms

Additional Services – Throughout the term of this Agreement, at times convenient to the Contractor and the Client, and upon the Client's request, the Contractor may provide additional consulting and/or professional services on an hourly rate basis at a rate of dollar amount US Dollars per hour or, at the option of the Client, up to ten1099 form independent contractor agreement By templatelabcom Contract Agreement Form Fill Online, Printable, Fillable, Blank By wwwpdffillercom 1099 form independent contractor agreement By wwwwisegeekcom 1099 form independent contractor agreement 9 Form By wwwsimonsesslercom independent subcontractor agreement templateSample 2 Independent Contractor Indemnification The parties understand and agree that this Agreement is not a contract of employment in the sense that the relation of master and servant exists between District and Republic or between District and any employee of Republic Republic shall, at all times, be deemed to be an independent contractor

1099 Form Independent Contractor Agreement

Independent Contractor Agreement Pdf Template Kdanmobile

1099 Contractor 50/50 split Same $96,000 1099 gets $48,000 You get $48,000$19,0 (% for expenses) = $28,800 But, your expenses will not go up much, renting her/him space will be the same, so post $28,800 you may only have 10% in expensesThis agreement can protect your assets and any trade secret or other confidential information If you are an independent contractor, this agreement will protect your interests if you provide work and are not paid If you provide a contract for your clients youAgreement for Independent (IRS Form 1099) Contracting Services _____________________, referred to as CONTRACTING PARTY, and ___________________, referred to as INDEPENDENT CONTRACTOR, agree INDEPENDENT CONTRACTOR shall perform the following services for CONTRACTING

Independent Contractor Agreement Template Approveme Free Contract Templates

Independent Contractor Contract Template The Contract Shop

Agreement ☐ Contractor has the sole right to control and direct the means, manner, and method by which the Services required by this Agreement will be performed Contractor shall select the routes taken, starting and quitting times, days of work, and order the work is performedAn independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreement

Independent Contractor Agreement Template 3 Pdfsimpli

Telemarketing Agreement Self Telemarketing Agreement Sample Us Legal Forms

I Pinimg Com 736x 9d A3 2c 9da32c4b9eab2df66e11

Free Independent Contractor Agreement Template Download Wise

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement The Association Of Fitness Studios

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

18 Contractor Agreement Examples Pdf Word Docs Examples

Independent Contractor Agreement Template Foundd Legal

Independent Contractor Agreement Template Contract The Legal Paige

Free Independent Contractor Agreement For Download

Sample Independent Contractor Agreement

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Www Printablelegaldoc Com Wp Content Uploads

Free Independent Contractor Agreement Free To Print Save Download

Sample Independent Contractor Agreement In Word And Pdf Formats

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement Pdf Templates Jotform

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

2

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

1099 Contract Employee Agreement

Free Florida Independent Contractor Agreement Pdf Word

30 Simple Independent Contractor Agreements 100 Free

Independent Contractor Agreement Business Lawyer Tampa

Create A Free Construction Contract Agreement Legal Templates

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Independent Contractor Agreement Bestdox

Independent Contractor Contract Template Awb Firm

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Creative Contracts

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

The Ceo Legal Loft Shop Small Business Legal Resource

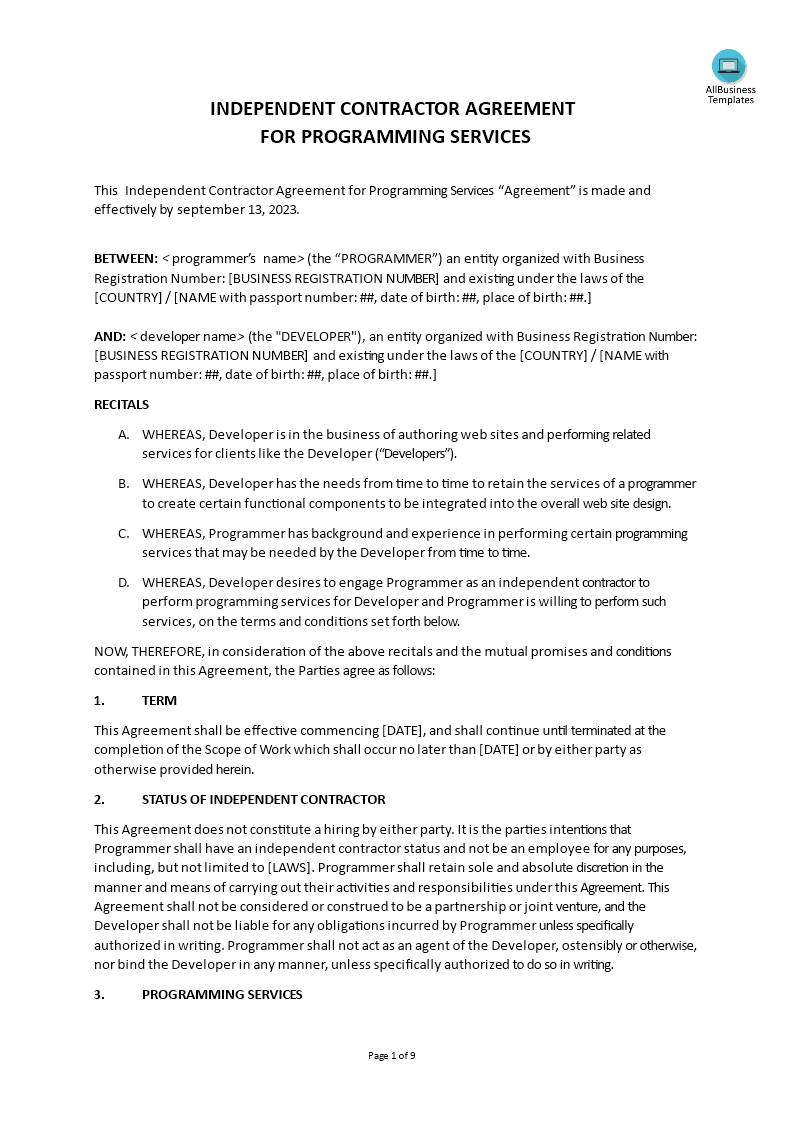

Independent Contractor Agreement Programming Templates At Allbusinesstemplates Com

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Independent Contractor Agreement Not Your Father S Lawyer

3

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Contractor Agreement Template 23 Free Word Pdf Apple Pages Document Download Free Premium Templates

Use A Nda With Independent Contractor Agreements Everynda

Independent Contractor Agreement Sample Tennessee In Word And Pdf Formats

Free Texas Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Commission Agreement Online Business Templates At Allbusinesstemplates Com

Independent Contractor Agreement Template Contract Agreement Contractor Contract Nomad Legal

1

Http Www Ct Gov Hix Lib Hix Ahctmaximuscontract Pdf

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Prima Independent Contractor Agreement

Independent Contractor Agreement Sample Template

Independent Contractor Agreement Etsy

Free Independent Contractor Agreement For Download

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Is Client Service Agreement Same As Independent Contractors Agreement In Us Quora

Independent Contractor Agreement Agreement For Consulting Services

Free Independent Contractor Agreement Pdf Word

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

Free Independent Contractor Agreement For Download

Free 7 Sample Independent Contractor Agreement Forms In Pdf Ms Word

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Creative Contracts

Independent Contractor Agreement Template Free Pdf Sample Formswift

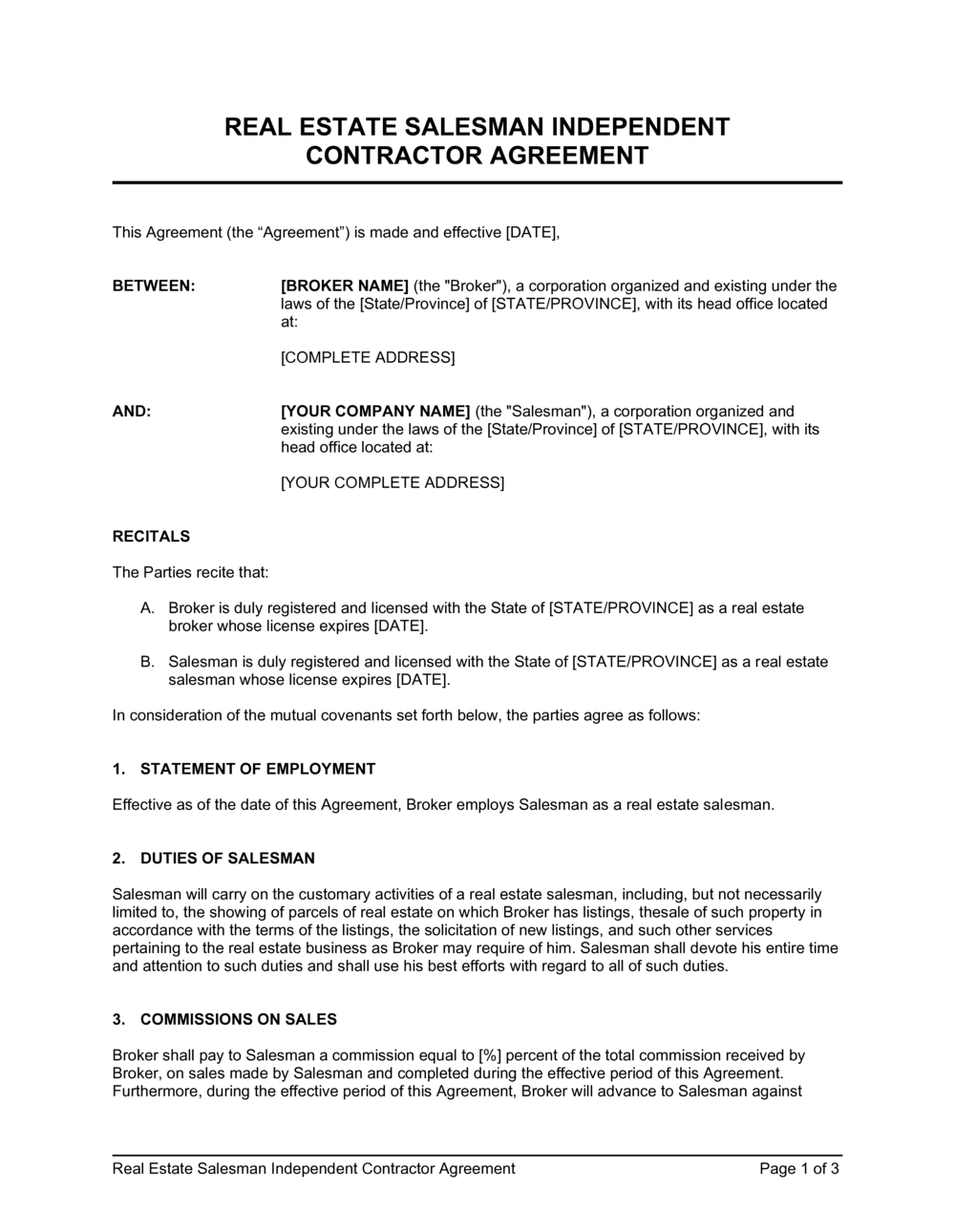

Real Estate Salesman Independent Contractor Agreement Template By Business In A Box

Create An Independent Contractor Agreement Download Print Pdf Word

Independent Contractor Agreement Legalforms Org

3

Free Independent Contractor Agreement Template For 21 Bonsai

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Contractors

Independent Contractor Agreement Template Lawdistrict

Independent Contractor Agreement Template My Word Templates

0 件のコメント:

コメントを投稿